Victor Anthony

Victor AnthonyA 10-year insurance professional and Chartered Property Casualty Underwriter (CPCU), and expert in the latest trends and emerging information across the auto insurance industry, informs teens on the best strategies to save on their car insurance policy.

Locating the best insurance for teen drivers helps to ensure they have both adequate coverage, and a policy providing value in exchange for the premium spend. As an experienced insurance industry professional, I have seen changes in how auto insurance is approached by carriers. Autonomous vehicles, the emergence of high-technology safety features, all change the way auto insurance is priced.

Bringing my decade of experience forward, the goal is to help you find the best insurance for your teen driver today!

Essential Criteria for Identifying the Best Insurance

Having worked several years an underwriter, I have learned how to balance price with quality. Teen drivers need to seek value when it comes to their auto insurance policy. This means having a combination of both comprehensive coverages, as well as an affordable premium price point.

01.Understand the Average Costs

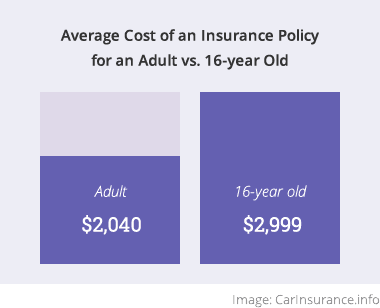

The first step in finding the best auto insurance policy for a teen is to understand the average cost.The average cost of an auto insurance policy for a 16-year old teenager is $2,999. Once you are outside of your teenage years, the premium average drops by nearly $1,000. Even gender plays a role in average costs. A teenage male will carry a higher premium average in comparison to a female. The premium for an average 16-year old male is $3,897, while a female will be quoted the same policy for $3,387.

02.Know Why The Premiums Are High

Insurance companies are in the market to turn a profit where possible. One of the ways they do this is to reduce what they refer to as their loss ratio. The loss ratio is the ratio of one dollar of premium earned and how much of that ends up as loss payments. The loss ratio for teen drivers is high, thus to cover those losses, premium dollars need to be high as well.

03.Enter the Market With Knowledge

You want to enter the car insurance market with knowledge. Know the basics of car insurance discounts for students, in which insurance companies typically provide the cheapest car insurance for teens. The more your knowledge base, the easier the shopping experience will be.

04.Obtain Several Quotes

You want to obtain several car insurance quotes to get the best teen auto insurance policy. Obtain a combination of quotes from major national insurance companies, as well as more local and niche carriers. Compare each of the premiums and their related coverages to weigh the differences across the companies. A great tool would be something like QuoteWizard.com or Insurance.com, which lets you search for policies and receive multiple quotes at once across many insurance carriers.

05.Check Discount Offerings

There may be certain car insurance discounts based on your school or job. Nationwide, for example, offers a 10% discount when your teen completed an approved driver safety course. Safeco offers a Teen Safety Rewards program which offers a discount a B average, discounts for taking driver safety courses, and discounts if you retaitn Safeco as a carrier for more than two-years.

06.Sign For a Short-Term Policy

You are going to do two things when you sign on for short-term car insurance for teens policy. A short-term policy will allow you to get a lower premium price point, and also let you rely on positive driving habits to further reduce your premium at each renewal. A six-month teen car insurance policy is typically the best choice.

Cheapest Auto Insurance Companies for Teens – Expert Review

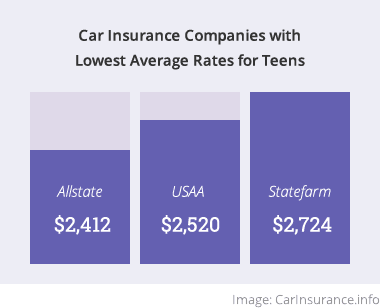

It always helps to have a sense of how certain insurance carriers will price teen auto insurance. The teenage car insurance average cost will vary from one insurance company to the next. Disclaimer: This research is not meant to be an endorsement for any particular company.

01.Allstate

Allstate – The average cost of a teen auto insurance policy from AllState is $2,412. The premium value gets even more benefits thanks to special discounts. Teens get 10% off when they complete a safe driving program, as well as up to 20% off when they have good grades, a “B” or better average.

02.USAA

USAA – USAA is limited to military members and their immediate family, so availability is a bit more difficult. If you do qualify, though, their average teen auto insurance premium comes in at just $2,520. Discounts of note include 10% off if other family members have USAA, and a percentage off for maintaining good grades of a “B” average or better.

03.State Farm

State Farm – The average teen auto insurance premium from State Farm is $2,724. State Farm also offers a 15% discount for completing their Steer Clear Safe Driver Education course, as well as an impressive 25% off for good grades, the highest in the industry.

How to Decrease Car Insurance Costs for First Time Drivers

Buying car insurance for first-time drivers can be an expensive proposition. The cost is due to the risk that comes with the business for the insurance carrier. The leading cause of death among teenagers is a motor vehicle crash. Teen auto insurance carries with it a much higher risk of accident and related claims and losses in comparison to auto insurance for adults. Decreasing car insurance costs for first-time drivers is possible if you have a strategy.

01.Add the Driver to a Family Policy

One of the ways to save money on the teenage car insurance average cost is to add the driver to a family policy. The average cost of a teen auto insurance policy is approximately $2,600. If you were to simply add that teen and his or her car to your existing family insurance policy, the premium would likely only go up around $600 or $700. That is a massive saving versus buying a separate mono line auto insurance policy.

02.Find an Insurer Who Cares About Your Habits

You may be a responsible teenager, but an insurance carrier does not know that. New technology is allowing insurance carriers who care to track your driving habits, your history, and provide discounts in exchange for these good habits. Find an insurance carrier like Liberty Mutual with their RightTrack platform who cares about these details so you can break the mold of what they think of you as a teen driver and risk. Having RightTrack typically saves 5% off your policy right away and up to 15% off after depending on your tracked driving habits. Although this list is not exhaustive, other popular telematics offerings from insurance carriers include:

| Companies That Offer Telematics | |||

|---|---|---|---|

| Allstate: | Drivewise | National: | General (via Onstar) |

| Nationwide: | SmartRide | State Farm: | Drive Safe & Save |

| Hartford: | TrueLane | Travelers: | Intellidrive |

| LibertyMutual: | RightTrack | Progressive: | SnapShot |

01.Stick to a Short-Term Policy

Unbeknownst to most shoppers, you want to stick to a short-term auto insurance policy to help keep premium costs down. When your policy renews as a teen every six-months versus a year, you will see your premium begin to lower pending you have no loss history. This allows you to continue to showcase positive driving habits, elapsed time with no losses, and enjoy premium reductions as a result.

02.Drive a Reasonable Car

A brand new teen driver who is blasting around in a convertible is going to carry a higher premium price tag than a driver with a more reasonable sedan. Have your teen drive something in-between a junk box and a brand new vehicle.

A junk box carries an increased risk of accidents, while a new car carries much higher repair bills. A responsible vehicle helps to keep premium costs as low as possible and your teen driver safe. Other variables with your car include how likely it is to be stolen, its cost for repairs, the size of the engine, and safety technology.

According to analysis of national insurance filing data (although you should always price shop to be sure), among 25 of the most popular cars today, annual average premiums lows and highs include:

- Subarus and even Jeeps are surprisingly less expensive to insure at around the $1400 – $1500 range;

- Value cars such as Toyota Corolla, Camry, Nissan Sentra and Altima run a surprisingly $1600 – $1700 a year.

Teen Car Insurance FAQ

Car insurance for teenagers and first-time drivers can be a difficult purchase to make. The best car insurance for college students will be one that delivers that ideal combination of comprehensive coverage and value in premium affordability. Locating such an auto insurance policy takes homework, but having foundational knowledge before you begin your search assists greatly.